Transaction Process

How to Buy a HomeSingle Family Home

A single-family home (often abbreviated as SFH), house or dwelling is a free-standing residential building that is maintained as a single dwelling unit. Even if the dwelling unit shares one or more walls with another unit, it is considered a single family home if it has direct access to a street and does not share heating facilities/equipment, water equipment, nor any other essential facility or service.

Condo

A condominium is usually attached housing, where the buyers/owners of each unit own their individual unit and a portion of the private land that the building sits on, as well as any amenities. All condominium buildings have associations (often referred to as Homeowner Associations) that govern/oversee the policies of the condominium building as a whole, allocate expenses for maintenance, and collect the homeowner association fees.

Co-Op

Co-operative (Co-Op) housing is the form of ownership in which the whole property is owned by a co-operation and then sold as shares to the individual buyers/owners of the community. Co-operative housing typically shares the costs of upkeep and maintenance and shares amenities across all of its members.

Tenancy In Common (TIC)

Tenancy In Common (TIC): In a TIC, a building is owned by a TIC group in percentage shares, including the rights to occupy a particular unit. Each owner has a distinct, separately transferrable interest in the building as a whole. All areas of the property are owned equally by the group, and therefore an individual may not claim ownership to a specific part of the property.

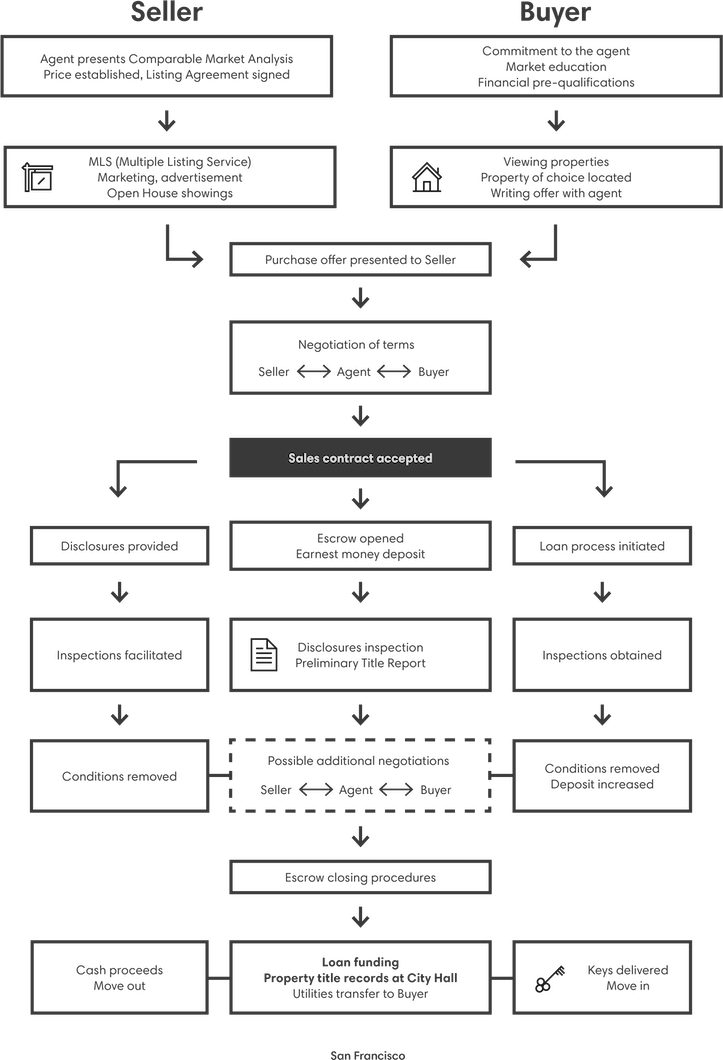

The flow of a real estate transaction

Disclosures

In Marin County, it’s typical for the listing agent to provide a general disclosure package to all serious buyers. This is your opportunity to review general information about the property prior to writing an offer. It is required that the sellers and agent disclose everything they know about the property and that you are aware of anything that might affect your decision to purchase the property.

Real Estate Transfer Disclosure Statement (called theRETDS) and Seller Property Questionnaire

These two disclosures are questionnaires about the condition of the property and neighborhood.

Preliminary Title Report

Provided by the Title Company, a preliminary report documents ownership, vesting, and detail regarding anything recorded against the home, such as liens, encroachments, or easements.

Pest Inspection Report

Sometimes referred to as a “Termite Report”, it examines all types of insect and fungus damage (Section 1) as well as conditions that could lead to damage (Section 2). This inspection is performed by a specially licensed contractor who must inspect properties according to criteria established by the State Board of Pest Inspection.

Natural Hazard Zone Disclosure (Property ID or JCP Report)

This report gives you all information about how the property might be affected by a natural hazard. Earthquake, Wildfire, Tsunami, Flood, etc. based on its specific location.

Home Inspection

A home inspection will check the overall condition of the home from the foundation to the roof, including electrical, plumbing, and heating, the basic structure, as well as the quality of the finish work. Other recommended inspections may include structural engineering, soil conditions, fireplace and furnace. The inspection period is useful for obtaining estimates for repairs and improvements you plan to make later.

Agent’s Visual Inspection Disclosure

Each agent will conduct a visual inspection of the property to identify red flags.

Making the offer

Q: WHAT IS A GOOD OFFER?

A: A good offer depends on multiple factors: the market, the neighborhood, the seller needs and the list price. It is your agent’s job to provide you with the best information on these factors to help you make a decision. Is the list price low or high compared to the market? Is your offer the only one on the table or are there several you are up against? Are properties in general selling above or below asking in the neighborhood?

Q: HOW DO YOU WIN IN A MULTIPLE BID SITUATION?

A: Primarily by understanding the strategy and motivation of the sellers. It is important to know how many other offers are on the table, the state of the market, and the goals of the seller. An offer is more than a purchase price—a good offer is drafted carefully with overall terms that will appeal to the seller.

Q. HOW LONG WILL IT TAKE FOR ME TO HEAR IF I/WE GOT IT?

A: We generally give 24 hours for the seller to respond. In some cases the seller requests more time, but usually no more than a couple days. In the case of a short sale or REO, it can take weeks or months to hear back from the bank.

Q: WHAT IS THE COUNTER OFFER? HOW DOES IT WORK?

A: When you submit an offer, the seller has four choices:

- They can ACCEPT it as written, and you are ratified—meaning you are “in contract” to buy it.

- They can REJECT it.

- They can offer you a “BACK-UP” position—in the case that they have accepted another offer, this will put you in first position to ratify if the first offer cancels or falls through.

- They can COUNTER your offer. They can counter you on the purchase price, the length of escrow, contingency periods, or any other terms. Once you receive their counter you can then 1) Accept 2) Reject or 3) Counter their counter. This can go back and forth many times until both sides come to an agreement. As soon as one party agrees to the other’s counter, you are ratified.

Q: WHAT IS A MULTIPLE COUNTER OFFER?

A: If a seller receives more than one offer, they can counter all of them or a select few. In this scenario, the offer is not ratified when you respond to their counter. The seller has the final say, therefore you are not ratified until the seller accepts your counter.

Escrow

Escrow: What is it?

Escrow is the period of time between your offer being accepted and your purchase being finalized. Escrow is a neutral third party. Escrow protects all of the relevant parties in a real estate transaction, including the seller, the home buyer, and the lender, by ensuring that no escrow funds from your lender and other property change hands until all of the conditions in the agreement have been met. Along the way, proper documentation is filed with the escrow agent or the escrow company as each step toward closing is completed.

Why Do I Need an Escrow?

Whether you are the buyer, seller, lender or borrower, you want assurance that no funds or property will change hands until ALL of the instructions in the transaction have been followed. The escrow holder has the obligation to safeguard the funds and/or documents while they are in the possession of the escrow holder, and to disburse funds and/or convey title only when all provisions of the escrow have been complied with. The escrow officer is a neutral third party and does not represent any one party. Your title company will provide you with a preliminary title report for the buyer to be made aware of any encumbrances on the property. Your title company also provides title insurance to ensure delivery of clean title.

How Does Escrow Work?

The principals to the escrow—buyer, seller, lender, agents—cause escrow instructions, most usually in writing, to be created, signed and delivered to the escrow officer. If a broker is involved, he will normally provide the escrow officer with the information necessary for the preparation of your escrow instructions and documents. The escrow officer will process the escrow, in accordance with the escrow instructions, and when all conditions required in the escrow can be met or achieved, the escrow will be “closed.” The duties of an escrow holder include: following the instructions given by the principals and parties to the transaction in a timely manner; handling the funds and/or documents in accordance with the instruction; paying all bills as authorized; responding to authorized requests from the principals; closing the escrow only when all terms funds in accordance with instructions and provide an accounting for same: the Closing or Settlement Statement. The escrow officer can ONLY take instructions from all parties in agreement. No one party in the transaction can solely give instructions. The escrow officer does not represent any one party—they are a neutral 3rd party in the transaction.

How Long Does Escrow Last?

This is determined on a case by case basis and will be written into the offer. Generally, 30 days is common. However, in some cases, you (or the seller) may need more or less time.

Who Chooses the Escrow?

In the Bay Area, it is usually the buyer’s choice, as the buyer pays the escrow fees. The selection of the escrow holder is normally done by agreement between the principals. If a real estate broker is involved in the transaction, the broker may recommend an escrow holder. However, it is the right of the principals to use an escrow holder who is competent and who is experienced in handling the type of escrow at hand. There are laws that prohibit the payment of referral fees; this affords the consumer the best possible escrow services without any compromise caused by a person receiving a referral fee.

What Happens During Escrow?

The escrow period gives all parties involved the time needed to comply with the terms of the offer and prepare to transfer title from the seller to the buyer. During this time you do several things all of which your agent we’ll assist you with:

- You put down a refundable deposit of 3% of the purchase price which is held by the Escrow/title company. (Referred to as Earnest monies, or good faith deposit).

Your lender processes your loan and will ask you for various information needed to approve you. - Review and sign disclosures.

- Do your due diligence on the property and remove your contingencies by the deadlines requested in your offer.

- Have inspections completed if they were written into your offer.

- The lender orders an appraisal for the property.

- You sign all alone and title documents when they’re ready.

- Closing happens a couple days after you sign documents.

- You put down a refundable deposit of 3% of the purchase price which is held by the Escrow/title company. (Referred to as Earnest monies, or good faith deposit).